Imports and sales at second-hand car dealerships are booming.

In this article, we will analyse the trends in a booming market in Europe.

The current and future state of the used car market in Europe in numbers

The current outlook for the second-hand car sector is quite positive.

We will explore the current situation and prospects for the coming years, focusing on Germany, the United Kingdom, Spain, France, Italy and Portugal.

Europe

The European used car market is currently valued at £59.12 billion and is expected to reach £73.32 billion by 2030, reflecting an annual growth rate of 4.42%.

The digitisation of the market, improving reach and transparency, financing solutions, as well as recent widespread price increases, have driven demand for second-hand vehicles to historic levels.

Electric vehicles have experienced the strongest growth, and the positive trend is expected to continue with an increase of 18% between 2025 and 2030.

In contrast, strict emissions standards in Europe (Euro 7 regulations) have significantly increased production costs and, therefore, the final price of new vehicles, pushing demand towards second-hand models.

Germany

Germany closed 2024 with almost 6.48 million used vehicle transactions, representing annual growth of 7.4%, compared to a 1% decline in new vehicles.

For the first half of 2025, the number of transactions stood at 2.75 million vehicles. This stable level, with a slight increase of just under one per cent, exceeds the figures for the same period last year.

Electric and hybrid vehicles are experiencing the greatest increase in demand, although they have not overtaken diesel or petrol, and the trend is expected to continue over the next five years.

United Kingdom

The number of used vehicle transactions increased by 7.2% year-on-year for the second quarter of 2024, according to the Society of Motor Manufacturers and Traders.

Used car sales in 2024 reached 7,643,180 units, an increase of 5.5% year-on-year. In the first quarter of 2025, 2,020,990 cars were sold, 2.7% more than in the same period last year.

The most popular models in 2024 were the Ford Fiesta (306,207 sold), followed by the Vauxhall Corsa and VW Golf.

The market shows a clear trend towards electrification of the fleet and strong demand for recent used models.

Spain

In 2024, it was the best performing country in terms of used car sales among the main European markets, according to the statistical agency Mordor Intelligence.

During the first half of the 2024-25 financial year, demand for used vehicles in Spain increased by 7.5%, making it the fastest growing market in Europe.

More than 50% of vehicles sold were diesel, and sales of electric and plug-in hybrid vehicles increased by almost 60% and 90% respectively.

The average value of a 3-year-old car with 60,000 km was €19,864 in March, 1.4% more than a year earlier, according to data analysed by Autovista24.

France

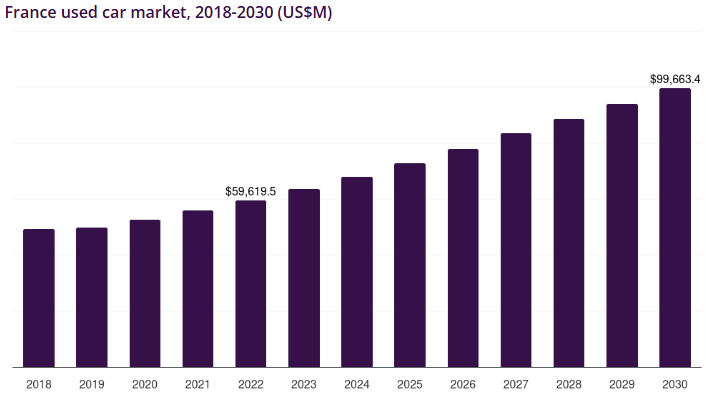

As in the previous countries, the growing trend in demand for used cars continues to rise, at a compound annual growth rate of 6.5%, which is expected to continue over the next few years, according to the Horizon Reports and Statistics Portal.

By 2024, the market generated revenues of $68,029.9 million and is expected to reach $99 billion by 2030, representing 3.6% of the global second-hand car market in 2024.

Although diesel cars and older cars (over 8 years old) are the most in demand, there is a clear decline in favour of electric vehicles, which account for 15.3% of sales.

Italy

Different country, same trend.

In Italy, transfers of ownership at the beginning of 2025 increased by 4.7%.

Most of these were cars, with a 4.4% increase in transfers, followed by motorcycles, which recorded a 6.5% increase.

Similarly, demand for hybrid and electric vehicles is clearly on the rise. Specifically, hybrid petrol vehicles recorded an increase of 33.8%, reaching a share of 8.7%, while electric vehicles grew by 50.4%, now reaching a share of 1%, according to reports from the ACI Statistical Agency.

Portugal

The second-hand market in Portugal also shows positive and encouraging data.

After stagnating during the pandemic, the used car sector is now showing very positive results. Used car sales grew by 4.4% in the first half of 2024, compared to the same period last year.

The best-selling brands are Renault, the electric Clio model, Peugeot and BMW.

In terms of demand for electric vehicles, Portugal has established itself as one of the most dynamic markets for the adoption of electric vehicles (EVs), both new and used.

Conclusions

Given the above data, it can be concluded that:

- In Europe, the used vehicle market has a clear growth trend for the coming years, gaining ground on the new vehicle market.

- Demand for used hybrid and electric vehicles is booming as a result of new European regulations that are shifting consumer decisions towards cleaner models.

- The digitisation of the market plays a key role in driving second-hand vehicle transactions in recent years, improving transparency, proximity and product reach.

- Germany continues to dominate the used car market, followed by the United Kingdom, France and Italy. To a lesser extent, but also very important, are Spain and Portugal.

Sources:

Mordor Intelligence – Statistical Agency

Research Gate – Analysis and Statistics